Professional Tax in Telangana

Update on: 05-April-2025 03:10:48 PM | Published on: 22-March-2025 08:40:48 PM | 8 Minutes Read

Professional Tax Registration is mandatory for all individual involved in any trade or business activity or any profession

Table of Contents

Overview of Professional Tax in Telangana

Professional Tax is a tax levied by the state government on individuals earning an income from salary, profession, trade, or business. In Telangana, it is governed by the Telangana Professional Tax Act, 1987.

Types of Professional Tax Certificates:

There are two types of certificates:

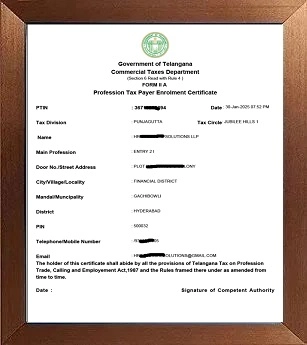

1. Professional Tax Enrollment (PTEC):

Professional tax enrollment applies to a wide range of entities, including companies, firms, limited liability partnerships, corporations, societies, Hindu undivided families, associations, clubs, as well as professionals such as legal practitioners, contractors, architects, engineers, tax consultants, management professionals, chartered accountants, lawyers, and medical representatives like doctors and professors.

PTEC Tax Slab Rate In Telangana for 2024-2025

Refer to the table below for the updated professional tax rates applicable to above category in Telangana.

|

Profession Tenure |

Professional Tax (₹) |

|

Up to 5 years |

Nil |

|

More than 5 years |

₹ 2500 p.a. |

2. Professional Tax Registration (PTRC):

Applicable for salaried employees, where the employer deducts the professional tax amount from the salary of the employee and deposits the tax to the state government.

PTRC Tax Slab Rate In Telangana in 2024-2025

Refer to the table below for the updated professional tax rates applicable to salaried individuals in Telangana.

|

Monthly Income (₹) |

Professional Tax (₹) |

|

Up to ₹15,000 |

Nil |

|

₹15,001 - ₹20,000 |

₹ 150 p.m. |

|

Above ₹20,000 |

₹ 200 p.m. |

Procedure for Professional Tax Registration

Procedure for Professional Tax Registration

Application Submission:

- Visit the official website of the Commercial Tax Department, Telangana.

- Submit the application form along with required documents.

Verification & Approval:

- The application and documents are verified by the authorities.

- Once approved, a Certificate of Registration (PTRC or PTEC) is issued.

Payment of Professional Tax:

- Employers need to deduct Professional Tax from employees’ salaries and pay it to the government monthly/annually.

- Self-employed individuals need to pay the tax annually as per the prescribed rates.

Documents Required for Ptax Registration

Documents Required for Ptax Registration

· PAN Card of the business entity or individual.

· Address Proof of the establishment (Electricity Bill, Rent Agreement, etc.).

· Proof of Profession: Trade License, Certificate of Practice, etc.

· Identity Proof: Aadhaar Card, Voter ID, Passport, or Driving License of the individual.

· Bank Account Details: Bank statement or a canceled cheque.

· Certificate of Incorporation / Business Registration Documents (if applicable).

· Memorandum & Articles of Association / Partnership Deed (if applicable).

· Nature of Business and Number of Employees.

Professional Tax Payment Due Date

Professional Tax Payment Due Date

- PTRC: Monthly payment by the 10th of the following month.

- PTEC: Annual payment by 30th June of each year.

Penalties for Non-Compliance

Penalties for Non-Compliance

- Late payment of Professional Tax attracts penalties and interest.

- Non-registration or non-payment may result in legal proceedings and additional fines.

Various Ptax Forms in Telangana

Various Ptax Forms in Telangana

The Telangana Commercial Tax Department requires various forms for Professional Tax-related processes. The main forms include:

|

Application Form |

Category |

|

Application for Registration |

|

|

Application for Certificate of Enrolment/Revision of Certificate of Enrolment |

|

|

Certificate to be Furnished by a Person to his Employer |

|

|

Certificate to be furnished by a Person who is simultaneously engaged in Employment of more than one Employer |

|

|

Returns of Tax Payable by Employer under sub-section (1) of Section 7 of the Telangana |

|

|

Paying in slip for making Payment to the Collecting Agents |

|

|

Receipt for the amount of tax, Interest and Penalty under the Andhra Pradesh Tax on Professions, Trades, Callings and Employments Act, 1987 credited to the Government Treasury by the Collecting Agent |

|

|

Appeal/Revision application against an Order of Assessment Appeal Penalty Interest |

|

|

Claim for Refund |

Frequently Asked Questions

Frequently Asked Questions

- Why is professional tax deducted?

- Professional tax is deducted as a statutory obligation by state governments to generate revenue for welfare programs and ensure legal compliance.

- Is professional tax compulsory in Telangana?

- Yes, professional tax is compulsory in Telangana for employers, salaried individuals, and professionals as per the Telangana Professional Tax Act, 1987.

- Can we skip professional tax?

- No, skipping professional tax is illegal, and non-compliance can result in penalties and legal action.

- Can professional tax be refunded?

- No, professional tax cannot be refunded as it is a statutory tax and not eligible for refunds once paid.

- Is professional tax the same for all employees?

- No, professional tax varies based on the employee's monthly salary slab as determined by the state government.

- Who is exempt from professional tax in Telangana?

- Professional tax in Telangana is exempted for members of the Indian Navy, Air Force, and Army serving in any part of Telangana.

- How to pay professional tax in Telangana?

- Professional tax can be paid online through the official website by providing the government ID, registration number, enrolment number, or application number for new enrolment.

- Is professional tax part of CTC?

- Yes, professional tax is part of CTC as it is deducted from the employee’s gross salary by the employer.

- Is professional tax deductible in the new tax regime?

- No, Professional Tax deduction is permitted under Section 16 of the Income Tax Act, but it is only allowed under the Old Tax Regime, not the New Tax Regime.

- Is there any professional tax for partners?

- Yes, partners of a firm are liable to pay professional tax if they are earning income through their profession or business, as per state laws.