GST Registration in India

Update on:26-February-2025 09:10:48 AM|Published on:28-February-2022 09:47:45 PM|7Minutes Read

GST Registration at ₹1000 in 10 to 15days

Table of Contents

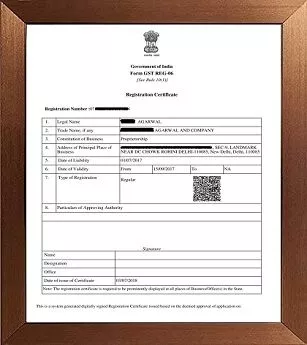

Sample GST Certificate

Overview of GST Registration in India

Goods and Services Tax (GST) is a unified indirect tax levied on the supply of goods and services in India. Any business that meets the prescribed turnover criteria or falls under the mandatory registration categories must register for GST. Businesses and individuals must register for GST under the following conditions:

Turnover Criteria

- For Goods: Businesses with an annual turnover exceeding ₹40 lakh (₹20 lakh for special category states).

- For Services: Businesses with an annual turnover exceeding ₹20 lakh (₹10 lakh for special category states).

GST Registration Process

- Visit the GST Portal – www.gst.gov.in

- Fill the GST REG-01 Form – Provide PAN, mobile number, and email for OTP verification.

- Submit Business Details – Enter business name, address, and type of registration.

- Upload Documents – Attach required documents as per the business type.

- Receive Application Reference Number (ARN) – Track the application status using ARN.

- Verification by GST Officer – If required, additional documents may be requested.

- GSTIN Issued – Once approved, a 15-digit GST Identification Number (GSTIN) is provided.

Documents Required for GST Registration

| Proprietorship | Partnership | Public Limited/ Private Limited |

| 1) Photo of the Proprietor. | 1) Photo of the Partners. | 1) Photo of the Directors |

| 2) PAN Card of Proprietor. | 2) PAN Card of Firm & Partners. | 2) PAN card of Company & Directors |

| 3) Aadhar Card of Proprietor. | 3) Aadhar Card of Partners. | 3) Aadhar Card of Directors |

| 4) Office address proof, Electricity Bill and Property Tax Receipt. | 4) Office address proof, Electricity Bill and Property Tax Receipt. | 4) Office address proof, Electricity Bill and Property Tax Receipt. |

| 5) Bank Certificate /Cancelled Cheque | 5) Bank Certificate /Cancelled Cheque | 5) Bank Certificate /Cancelled Cheque |

| 6) Any Licence of Business | 6) Any Licence of Business |

6) Certificate of Incorporation |

Benefits of GST Registration

- Legally Compliant – Avoids penalties and ensures smooth business operations.

- Input Tax Credit (ITC) – Allows businesses to claim tax credit on purchases.

- Wider Market Access – Essential for B2B transactions and interstate trade.

- E-Commerce Participation – Mandatory for selling on platforms like Amazon, Flipkart, etc.

- Enhances Business Credibility – Registered businesses gain trust among customers and suppliers.

GST Penalty for Non-Compliance

- Failure to Register: ₹10,000 or 10% of the tax due (whichever is higher).

- Deliberate Tax Evasion: 100% of the tax due.

- Late Filing: ₹50 per day (₹20 for NIL returns).

- Fraudulent GST Claims: Heavy penalties and possible legal actions.

Frequently Asked Questions

1. Who is required to register for GST?

-

Turnover Threshold: Businesses with an annual aggregate turnover exceeding ₹20 lakh (₹10 lakh for special category states) are required to register for GST.

-

Inter-State Supply: Any business engaged in inter-state supply of goods or services must register, regardless of turnover.

-

E-commerce Operators: Persons supplying goods or services through e-commerce platforms are mandatorily required to register.

2. Is GST registration mandatory for small retailers purchasing from dealers/wholesalers?

If a retailer's annual turnover is below the threshold limit (₹20 lakh or ₹10 lakh for special category states) and they are not engaged in inter-state supplies, GST registration is not mandatory.

3. Can a person with multiple business verticals obtain separate GST registrations?

Yes, a person having multiple business verticals in a state may obtain a separate registration for each business vertical, subject to prescribed conditions.

4. What is the time limit for applying for GST registration?

A person liable to register under GST should apply within 15 days from the date on which they become liable for registration.

5. Is PAN mandatory for obtaining GST registration?

Yes, having a Permanent Account Number (PAN) is mandatory for obtaining GST registration, except for a non-resident taxable person who may be granted registration on the basis of other documents as prescribed.

6. Can a person without GST registration collect GST?

No, a person without GST registration cannot collect GST from customers and is not entitled to claim input tax credit on purchases.

7. Is there a provision for voluntary GST registration?

Yes, a person can apply for voluntary GST registration even if their turnover is below the prescribed threshold. Upon registration, they must comply with all the provisions of the GST law.

8. What are the penalties for not registering under GST?

If a person who is liable to be registered under GST does not register, a penalty of ₹10,000 or 10% of the tax due (whichever is higher) may be levied.

9. Can a person operate in multiple states with a single GST registration?

No, a person must obtain a separate GST registration for each state from which they operate, as GST registration is state-specific.

10. What is the validity period of the GST registration certificate?

The GST registration certificate does not have an expiry date and is valid as long as the business is operational, except for casual taxable persons and non-resident taxable persons, where the certificate is valid for a specified period.

Conclusion

GST registration is mandatory for businesses exceeding the turnover threshold or falling under specific criteria. It provides multiple benefits, including tax credits and legal recognition. Aaranyak Consultancy can assist with GST registration, ensuring hassle-free compliance for your business.

Would you like assistance with the GST registration process? Call Us 9088449339

Success Stories & Reviews

Why Do Customers Love Us?

Registered by Govt. of India

Our website Security score A+

OnTime Service provides

5000+ Happy Customer, Healthy Business

Verified Customer Reviews

Trusted by

|

|

|

|

|