PF & ESI Registration at Best Price in India

Update on: 07-March-2023 09:09:00 AM | Published on: 28-June-2021 11:26:59 AM | 9 Minutes Read

Ideal for employers who provide their staff financing safety and health insurance. PF and ESIC registration under a voluntary scheme less than 20 employees.

PF & ESIC Registration at ₹3000 in 3 days.

Table of Contents

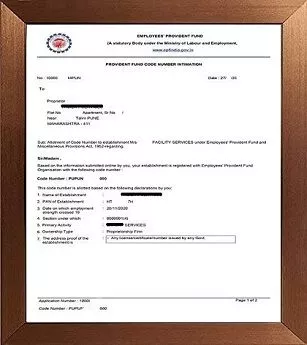

Sample PF Certificate

Overview of PF & ESIC Registration

Here's an overview of each registration:

Provident Fund (PF) Registration:

The Provident Fund (PF) is a social security scheme that is administered by the Employees' Provident Fund Organization (EPFO). The PF scheme applies to companies with more than 20 employees. Under this scheme, both the employer and employee contribute 12% of the employee's basic salary towards the fund.

Employees' State Insurance Corporation (ESIC) Registration:

The Employees' State Insurance Corporation (ESIC) is a social security and health insurance scheme that is administered by the Employees' State Insurance Corporation. ESIC applies to companies with more than 10 employees. Under this scheme, the employer's contribution at 3.25% and employee contribute at 0.75% of the employee's salary towards the fund.

PF & ESIC registrations provide social security benefits to employees and these registrations are mandatory for companies, non-compliance with the regulations may result in penalties.

Procedure for PF & ESIC Registration

Here's a step-by-step procedure for PF and ESIC registration in India:

Step 1: Sign up on the Shram Suvidha Portal

Step 2: Login to your account

Step 3: Click to “Register for EPFO-ESIC” button

Step 4: Click on “Apply for New Registration”

Step 5: Enter your Establishment details, e-contacts, Contact Persons, Identifiers, Employment Details, Branch/ Division and Business activity.

Step 6: Upload the documents like proof of address, date of setup proof, license proof and specimen signature.

Step 7: Submit the Form

Step 8: Once the application is processed PF and ESIC code number will be sent on the registered email id and SMS.

Therefore, it is advisable to seek professional help for the registration process and compliance requirements. Our expert of e-startup.in will file your application with the EPFO and ESIC on your behalf.

Documents Required For PF & ESIC Registration

The documents required for PF and ESIC registration are similar and include the following:

- Trade Licence or Msme Certificate or Dipp Start-up Certificate.

- PAN Card of the Proprietor or Firm or Company

- Aadhar Card of Proprietor or Partner’s or Director’s

- Electricity Bill, Telephone Bill, Rent Agreement, GST Certificate for address proof.

- First Sales Invoice or Small Scale Industry Certificate or Certificate of Incorporation.

- Specimen Signature Attachment.

- After complete the registration process some details are required for each employees.

- Name

- Date of Birth

- Father's Name

- Designation

- Date of joining

- Salary details (Basic pay, DA, HRA, etc.)

- Bank account details (Account number, IFSC code)

It is important to note that the documents may vary based on the type of organization, In addition to the above documents, the digital signature certificate (DSC) or e-sing of the authorized signatory are also required for registration.

Benefits of PF & ESIC Registration

PF and ESIC registrations provide various benefits to employees in India. Here are some of the key benefits:

Provident Fund Benefits :

a) PF account holders can take a loan against their PF balance.

b) PF account holders are eligible for tax exemption under Section 80C of the Income Tax Act,

c) PF provides pensions and retirement benefits to its employees after 58 years of service.

d) Financial security to employees and their family upon retirement, unemployment, or death.

e) PF is a low-risk investment as the funds are invested in government securities, bonds, and other safe instruments.

f) PF permits for Partial Fund Withdrawals in certain cases such as medical emergency, construction or purchase of new home, renovation of house, wedding of children or self.

Employees' State Insurance Corporation Benefits :

a) ESIC provides healthcare benefits to employees and their family.

b) ESIC provides financial security to employees by providing a safety net in case of medical emergencies.

c) ESIC provides disability benefits to employees in case of permanent or temporary disablement due to employment injury.

d) ESIC provides funeral expenses Rs.10,000/- to the family of the employee in case of his/her demise.

e) ESIC provides insurance benefits at a low cost as the contribution rates are lower than those of private insurance plans.

For employers, PF and ESIC registrations help in attracting and retaining talent, improving employee morale, and complying with legal requirements. Overall, PF and ESIC registrations provide social security benefits to employees and help in promoting the welfare of the workforce.

Frequently Asked Questions

Q: Who is eligible for PF registration?

A: All organizations with 20 or more employees are eligible for PF registration. However, organizations with fewer than 20 employees can also voluntarily register for PF.

Q: Who is eligible for ESIC registration?

A: All organizations with 10 or more employees are eligible for ESIC registration. The employee threshold for ESIC registration varies for different states in India.

Q: Is it mandatory to register for PF and ESIC?

A: Yes, it is mandatory for eligible organizations to register for PF and ESIC.

Q: What is the contribution rate for PF and ESIC?

A: The contribution rate for PF is 12% of the employee's basic salary, which is matched by the employer. The contribution rate for ESIC varies from 0.75% and 3.25% of the employee's gross salary, depending on the income slab.

Q: How frequently do PF and ESIC contributions need to be made?

A: PF and ESIC contributions need to be made on a monthly basis.

Q: What happens if an organization fails to register for PF and ESIC?

A: Failure to register for PF and ESIC can result in penalties and legal action.

Q: What are the benefits of PF and ESIC registration for employees?

A: PF and ESIC registrations provide social security benefits to employees, including retirement benefits, healthcare benefits, financial security, disability benefits, funeral expenses, and low-cost insurance.

Q: What are the benefits of PF and ESIC registration for employers?

A: PF and ESIC registrations help in attracting and retaining talent, improving employee morale, and complying with legal requirements.

Q: How long does it take to complete the PF and ESIC registration process?

A: The PF and ESIC registration process can take anywhere from a few days to a few weeks, depending on the completeness of the documents and the efficiency of the authorities. It is advisable to seek professional help for the registration process.