Apply TAN Registration for TDS Returns in India

Update on: 07-March-2023 09:09:48 AM | Published on: 29-June-2021 10:53:22 AM | 8 Minutes Read

TAN Registration is mandatory for entities responsible for deducting or collecting tax at source. It helps in tax deduction simplicity and tax payment tracking.

TAN Registration at ₹400 in 15 days.

Table of Contents

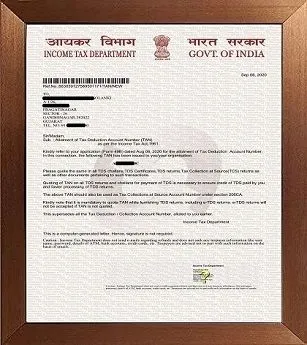

Sample TAN Certificate

Overview of TAN Registration

TAN stands for Tax Deduction and Collection Account Number. It is a 10-digit alphanumeric code that is issued by the Income Tax Department of India to entities who are responsible for deducting or collecting tax at source. TAN registration is mandatory for all entities who are liable to deduct or collect tax at source.

Procedure for TAN Registration

The procedure for TAN registration involves the following steps:

- Visit NSDL website https://tin.tin.nsdl.com/tan/index.html

- Click on the Tab "Online Application for TAN (Form 49B)"

- Go to “Apply for New TAN”

- Select the “Category of Deductors” from the drop down menu and click “Select” bottom

- Fill all mandatory fields marked with * on the form

- Select the payment option and submit the form

- On successful payment of Fees Rs.65/-an acknowledgment slip will be generated

- Applicant shall print the acknowledgment and send it to below address with documents

Protean eGov Technologies Limited,

4th floor, Sapphire Chambers,

Baner Road, Baner

Pune - 411015

The envelope should be written as 'APPLICATION FOR TAN - Acknowledgment Number………………………

It is important to note that the TAN application needs to be filled in accurately and all required documents need to be attached. Failure to do so can result in delays in the processing of the application.

Documents Required For TAN Registration

The following documents are required for TAN registration:

- PAN card of Proprietor or Firm or Company

- Aadhaar Card of Proprietor or Partner’s or Director’s

It is important to note that the documents submitted must be valid. In case of any discrepancies or errors in the documents, the TAN application may be rejected or delayed.

Benefits of TAN Registration

The following are the benefits of TAN registration:

- Simple TDS deductions if you have TAN Certificate

- Easy to payment challan no. ITNS 281

- View challan status

- Online TDS and TCS return filing

- TAN number ensures that the entity is in legal compliance

- This helps in the smooth processing of tax-related transactions

- The TAN number must be included on all tax documents.

- Download Conso File and Justification Report

- View TDS Certificate and download Form 16 / 16A

- TAN Certificate valid for a lifetime

- No Renewal needed for TAN Number

- This is online process no need to visit office for submit the document

Overall, obtaining a TAN number is beneficial for entities that are required to deduct or collect tax at source. It ensures legal compliance, easy tax deduction, and timely filing of tax returns, among other benefits.

Frequently Asked Questions

Q: Who is required to obtain a TAN number?

A: Entities that are required to deduct or collect tax at source are required to obtain a TAN number.

Q: What is the fee for TAN registration?

A: The TAN registration fee is Rs. 65 + GST (as of 2023).

Q: What is the validity of a TAN number?

A: TAN number is valid for the lifetime of the entity.

Q: Can a TAN number be surrendered or cancelled?

A: Yes, a TAN number can be surrendered or cancelled if it is no longer required by the entity.

Q: Can a single TAN number be used for multiple branches or divisions of an entity?

A: No, a separate TAN number needs to be obtained for each branch or division of an entity that is responsible for deducting or collecting tax at source.

Q: How long does it take to obtain a TAN number?

A: The processing time for TAN registration can vary, but it usually takes around 1-2 weeks from the date of submission of the application form and supporting documents.

Q: What are the consequences of not obtaining a TAN number?

A: Failure to obtain a TAN number can result in penalties and legal action by the Income Tax Department. The entity may also face difficulties in making payments to suppliers, contractors, employees, etc.

Q: Who needs to obtain a TAN number?

A: Entities such as companies, partnerships, trusts, and individuals who are responsible for deducting or collecting tax at source need to obtain a TAN number.

Q: How to apply for a TAN number?

A: You can apply for a TAN number by filling the TAN application form (Form 49B) and submitting it along with the required documents and fee to the nearest TIN-FC or NSDL TIN facilitation centre.

Q: What are the documents required for TAN registration?

A: The documents required for TAN registration include proof of identity and address of the entity, proof of identity and address of the authorized signatory, and proof of address of the entity.

Q: What is the penalty for not obtaining a TAN number?

A: Entities that are required to obtain a TAN number but fail to do so may be liable for a penalty of Rs. 10,000 (as of 2023) under Section 272BB of the Income Tax Act, 1961.

Q: Can a TAN number be used for purposes other than TDS?

A: No, the TAN number is exclusively used for TDS (Tax Deducted at Source) related transactions. It cannot be used for any other purpose.

Success Stories & Reviews

Why Do Customers Love Us?

Registered by Govt. of India

Our website Security score A+

OnTime Service provides

5000+ Happy Customer, Healthy Business

Verified Customer Reviews

Trusted by

|

|

|

|

|