Online Import Export Code at Best Price in India

Update on: 26-February-2025 09:07:42 AM | Published on: 28-January-2021 05:58:46 PM | 9 Minutes Read

Ideal for businesses or individuals who want to participate in global trade and expand their market reach.

Import Export Code at ₹1500 within 3 days

Table of Contents

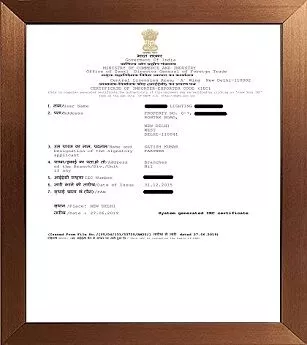

Sample Import Export License

Overview of Import Export License in India

In India, an import-export license is known as an Import Export Code (IEC), which is a 10-digit code issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industry, Government of India.

The IEC is required for businesses or individuals engaged in the import or export of goods from India. It is a mandatory requirement for obtaining benefits under various schemes like the Merchandise Export from India Scheme (MEIS) and the Service Export from India Scheme (SEIS).

Procedure For Import Export License in India

A Step By Step Guide For Import Export Code Registration as follows:

- Visit the DGFT website.

- Click on the ‘Services’ tab on the homepage.

- Enter Individual or Company PAN Information

- Enter your Mobile number to get OTP

- Fill the Application Details

- Add Branch Details if any

- Fill the Individual or Partner’s or Director’s details

- Upload the documents Scan copy

- Pay the application fee for IEC Rs.500/-

- Submit the application

- Receive the IEC: After the application is processed and approved by the DGFT, the IEC is issued and sent to the applicant through email or post.

It is important to note that the procedure for obtaining an IEC may vary depending on the type of business and the goods to be imported or exported. It is advisable to seek expert advice and assistance to ensure compliance with all applicable regulations and laws.

Documents Required For Import Export Code Registration

The following are the documents required to obtain an Import Export Code (IEC) in India:

- PAN card copy of the Individual or Firm's or Company's.

- Aadhaar card or passportcopy of the Individual or Partner’s or Director’s is required.

- A passport size photograph of the Individual or Partner’s or Director’s is required.

- Bank Certificate or Cancelled Chequeof the current bank accounts

- Electricity Bill copy or Property Tax Receipt or Rent Agreement copy of the Office premise.

- Any Licence of Business or Certificate of Incorporation or Partnership Firm Registration

It is also recommended to ensure that all the documents submitted are accurate and complete to avoid delays in the processing of the IEC application.

Benefits of Import Export License in India

There are several benefits of obtaining an Import Export Code (IEC) in India, including:

- Access to Global Markets

- Easy Processing of Customs Clearance

- An IEC ensures legal obligation compliance to importers and exporters.

- IEC Certificate valid for lifetime

- No renewal needed for Import Export Code

- After obtaining an IEC Code, you are not required to file any returns.

- Benefits Under the Merchandise Export from India Scheme (MEIS)

- Benefits Underthe Service Export from India Scheme (SEIS)

- IEC Code updates are simple to do online.

Overall, obtaining an IEC in India provides numerous benefits to businesses engaged in international trade. It facilitates easy access to global markets, participation in government schemes, and compliance with all relevant regulations and laws.

Frequently Asked Questions

1. What is an Import Export Code (IEC)?

An Import Export Code (IEC) is a 10-digit code that is issued by the Directorate General of Foreign Trade (DGFT) to businesses or individuals that are involved in the import and export of goods and services from India.

2. What is the fees for import export code registration?

The cost of obtaining an IEC is Rs. 500, which can be paid online through the DGFT website.

3. How long does it take to obtain an IEC?

The processing time for an IEC application is usually 2-3 working days after the submission of the application and required documents.

4. What is the validity of an IEC?

An IEC is valid for a lifetime and does not need to be renewed.

5. Who can apply for an IEC?

Any individual or business with a PAN (Permanent Account Number) and a bank account in India can apply for an IEC.

6. Who needs an IEC?

Any individual or business that wants to engage in import or export of goods or services from India needs to have an IEC. This includes exporters, importers, manufacturers, and traders.

7. How to apply for an IEC?

An application for an IEC can be submitted online through the DGFT website. The application requires certain documents, such as PAN card, Aadhaar card or passport, bank account details, and business details.

8. Is it mandatory to have an IEC for export of services?

Yes, an IEC is mandatory for the export of services from India. Service providers are required to obtain an IEC and declare their code while filing for the Service Export from India Scheme (SEIS) benefits.

9. What are the benefits of having an IEC?

Having an IEC enables businesses to engage in international trade legally and to access global markets. It also makes businesses eligible for government schemes, simplifies the customs clearance process, and makes them eligible for subsidies and incentives offered by the government of India.

10. Is it necessary to obtain a separate IEC for each branch of a business?

No, a single IEC can be used for all branches of a business across India. However, separate IECs are required for businesses with multiple business entities.

11. Is an IEC mandatory for all import and export activities?

Yes, an IEC is mandatory for all businesses or individuals engaged in import and export activities in India. It is a legal requirement under the Foreign Trade Policy of India.

12. Can an IEC be cancelled or surrendered?

Yes, an IEC can be cancelled or surrendered by submitting an application to the DGFT.

It is important to note that the specific requirements and procedures for import-export registration may vary depending on the nature of the business and the goods or services being imported or exported. It is advisable to seek expert advice and assistance to ensure compliance with all applicable regulations and laws.