Professional Tax in Tamilnadu

Update on: 05-April-2025 03:51:30 PM | Published on: 24-March-2025 09:21:30 PM | 5 Minutes Read

Professional Tax Registration is mandatory for all individual involved in any trade or business activity or any profession

Table of Contents

Overview of Professional Tax in Tamil Nadu

Professional Tax is a tax levied by the state government on individuals earning an income from salary, profession, trade, or business. In Tamil Nadu, it is governed by the Tamil Nadu Tax on Professions, Trades, Callings, and Employments Act, 1992.

Types of Professional Tax Certificates:

Professional Tax Enrollment (PTEC):

- Applicable to various entities, including companies, firms, LLPs, corporations, societies, HUFs, associations, clubs, and professionals like legal practitioners, contractors, architects, engineers, consultants, accountants, lawyers, and doctors.

- Every professional or self-employed individual needs to obtain this certificate to pay professional tax annually.

PTEC Tax Slab Rate In Tamil Nadu in 2024-2025

For PTEC, the tax rate is usually flat and annual for self-employed professionals, traders, freelancers, and other entities not employing salaried individuals.

- Annual Professional Tax (PTEC): ₹2,500 per year (Maximum)

The tax rate may vary slightly depending on the nature of the profession or business. However, the maximum limit is ₹2,500 per annum as per the Tamil Nadu Professional Tax regulations.

Professional Tax Registration (PTRC):

- Applicable for employers who deduct the Professional Tax from their employees' salaries and remit it to the government.

- Employers need to obtain this certificate to comply with the tax requirements.

PTRC Tax Slab Rate in Tamil Nadu (2024-2025)

Refer to the table below for the updated professional tax rates applicable to salaried individuals in Tamil Nadu.

|

Monthly Income (₹) |

Professional Tax (₹) |

|

Up to ₹21,000 |

Nil |

|

₹21,001 - ₹30,000 |

₹ 135 p.m |

|

₹30,001 - ₹45,000 |

₹ 315 p.m |

|

₹45,001 - ₹60,000 |

₹ 690 p.m |

|

₹60,001 - ₹75,000 |

₹ 1,025 p.m |

|

Above ₹75,000 |

₹ 1,250 p.m |

Procedure for Professional Tax Registration

Procedure for Professional Tax Registration

Application Submission:

- Visit the official website of the Commercial Taxes Department, Tamil Nadu.

- Submit the application form along with the required documents.

Verification & Approval:

- The application and documents are verified by authorities.

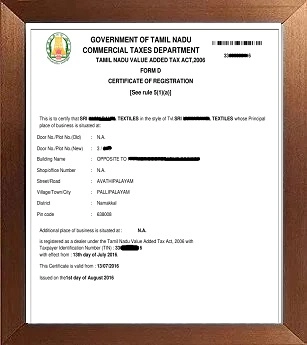

- Once approved, a Certificate of Registration (PTRC or PTEC) is issued.

Payment of Professional Tax:

- Employers must deduct Professional Tax from employees’ salaries and pay it monthly/annually.

- Self-employed individuals must pay the tax annually as per the prescribed rates.

Documents Required for Ptax Registration

Documents Required for Ptax Registration

- Legal Name of Employer: PAN is mandatory.

- Trade Name: If applicable.

- Constitution of Profession, Trade, etc.: (Sole Proprietor, Partnership Firm, Company, etc.)

- Nature of the Profession, Trade, etc.:

- Full Postal Address and Contact Details:

- Aadhaar & Mobile Number of Authorized Signatory:

- Photograph of Authorized Signatory:

- GSTIN, KST/CST, or Other Registration Numbers:

- Date of Commencement of Trade or Profession:

- Number of Employees:

- Scanned Documents: (Registration of Incorporation, Partnership Deed, Business Proof, etc.)

Professional Tax Payment Due Date

Professional Tax Payment Due Date

- PTRC: Monthly payment by the 20th of the following month.

- PTEC: Annual payment by 30th April of each year.

Penalties for Non-Compliance

Penalties for Non-Compliance

- Penalties may be imposed for delayed payments or failure to register.

- The penalty may be calculated as a percentage of the outstanding amount or a fixed rate as prescribed by the state government.

Frequently Asked Questions

Frequently Asked Questions

- Why is Professional Tax deducted?

To generate revenue for the welfare of the state and to ensure legal compliance. - Is Professional Tax compulsory in Tamil Nadu?

Yes, it is mandatory for employers, salaried individuals, and professionals as per the Tamil Nadu Tax on Professions, Trades, Callings, and Employments Act, 1992. - Can Professional Tax be skipped?

No, skipping Professional Tax can result in penalties and legal action. - Can Professional Tax be refunded?

No, it is a statutory tax and non-refundable once paid. - Who is exempt from Professional Tax in Tamil Nadu?

Members of the Armed Forces, individuals above 65 years, and other categories specified by the government are exempt.